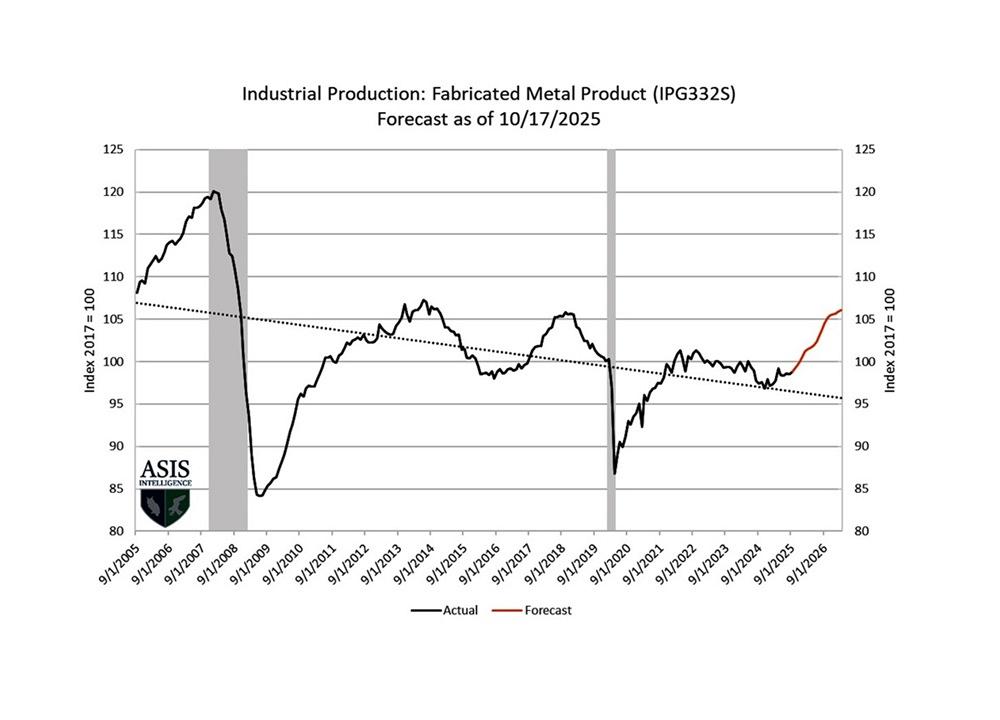

When John Nelson reviewed the numbers for the metal fabrication sector, he saw the results and, according to Chris Kuehl’s telling, did a double take. Nelson helps Kuehl put together The Watch, a monthly publication that tracks and forecasts the performance of various sectors, including custom and contract metal fabrication. In late 2025, The Watch’s numbers revealed that fabricators could see some significant upticks in the order book. For some concentrated in certain growth markets, business might be outright booming.

“I remember talking with John,” said Kuehl, managing director of Armada Corporate Intelligence and economic analyst for the Fabricators and Manufacturers Association. “He looked at the data six ways from Sunday, and even after that, he said, ‘Wow, these results are dramatic.’ But it made sense, considering the variables driving other sectors.”

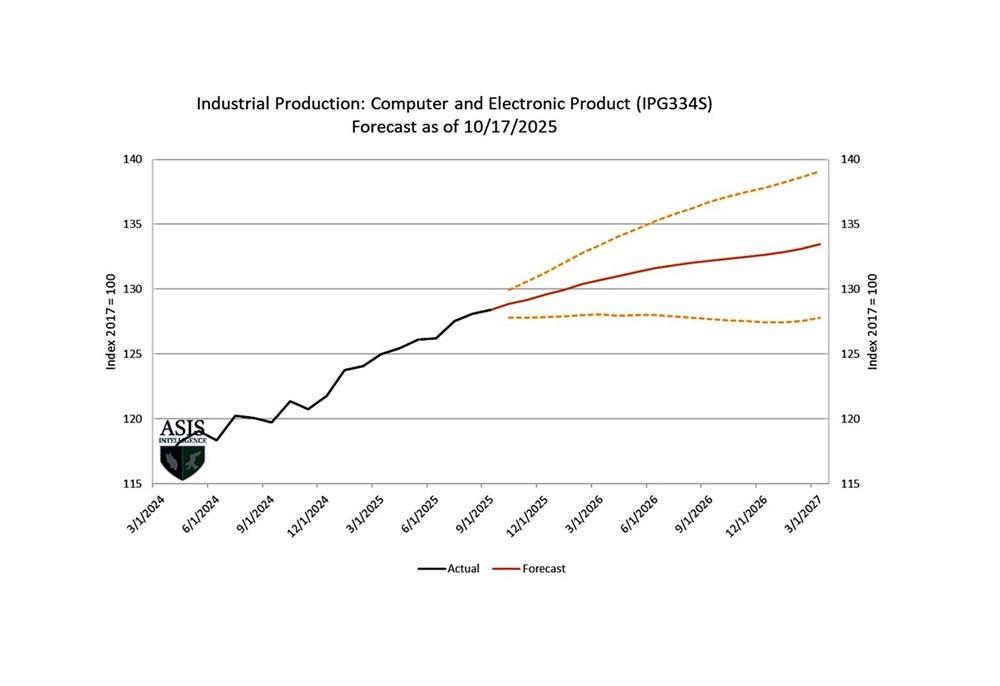

The Watch is created through a collaboration of Armada Corporate Intelligence and Morris, Nelson, and Associates. Over the past few years, the fabricated metal products sector has tracked near the 100 benchmark (signifying a business level fabricators operated at in 2017), sometimes a little less. The October 2025 edition showed fabricators operating slightly less than the 2017 benchmark—but the projection doesn’t have the sector lingering there (see Figure 1).

In 2026 alone, production could grow by 5.5%. Compare that to the 2.19% growth projected for 2025 and the slight contraction (-0.74%) the industry saw in 2024. For a sector that feeds other sectors, metal fabrication’s uptick says a lot about the overall state of U.S. manufacturing: Some sectors continue to struggle while others are booming—really, really booming.

About Data Centers

2025 was a year of transition. Some shops have benefited from reshoring, but others dealt with shrinking backlogs as uncertainty over tariffs, trade, inflation, and interest rates held many projects back. In normal business cycles, that wide range of business activity would average out to steady but lackluster growth—similar to what the industry has seen for years. This year, though, the data center boom has pushed that average skyward.

“It actually shocked us a bit when we saw just how strong the fabricated metal sector was,” Kuehl said. “But that’s what you get with where data center construction is right now. Other sectors are showing real strength, too, including medical. Really, when you look at the numbers, there’s no mystery.”

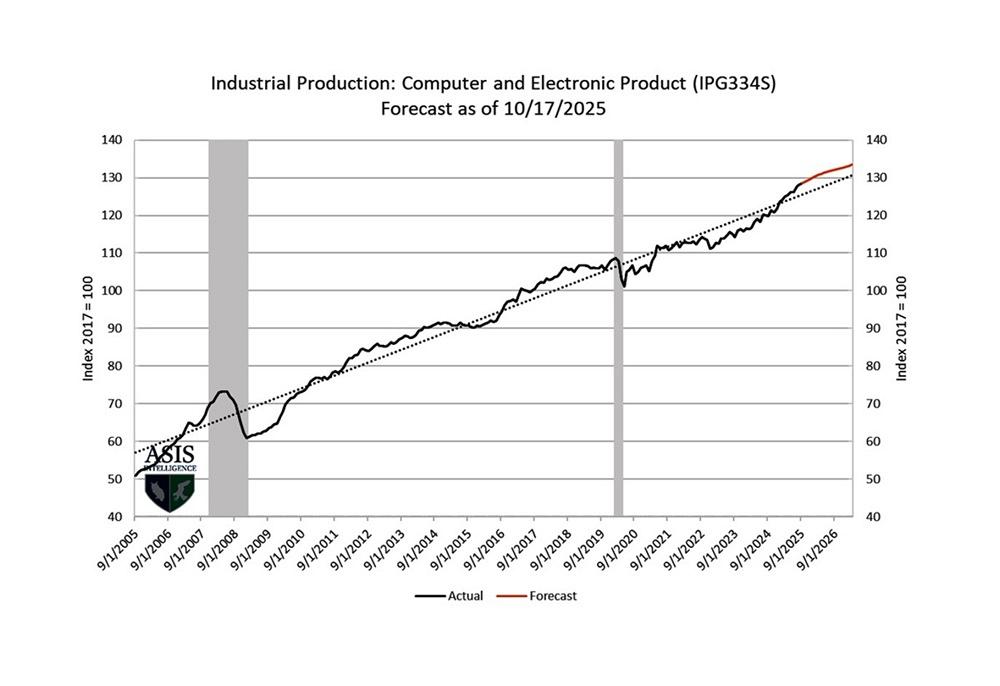

Kuehl referred to a chart showing a sector that’s in the economic driver’s seat: computers and electronics, which incorporates server racks and other components around data centers (see Figures 2 and 3). Unlike nearly every other sector connected with metal manufacturing, the computers and electronics numbers were holding well above the 2017 baseline. By March of 2027, sector-wide growth could be dramatic, even transformational. All the money being poured into metal fabrication has pushed serious investment into machinery, software, and (not least) mergers and acquisitions.

Worries about the AI boom persist. “Today, everyone wants to get on the bandwagon when it comes to computers, electronics, and data centers,” Kuehl said. “But I’m now hearing from investors saying everyone now needs to think like a credit manager. You know projects are getting financed, but where’s the money coming from?”

Still, fabricators don’t want to leave money on the table, so they’re not avoiding the data center boom. At the same time, the boom is giving shops the cash flow they need to reinvest. When the party around data centers stops, fabricators have plenty of other sectors to serve.

Everything Else

For perspective, Kuehl drew from some historical data (see Figure 4). “Metal fabrication still isn’t skyrocketing off the charts. In truth, it’s returned to where we were three or four years ago. And as you can see, we’re still not back to where we were in 2006 and 2007.” Still, the projected upturn is hard to ignore. Could the industry be at the start of a long-term rebirth, returning to and even surpassing levels seen in 2007? How smooth the upturn will be will depend on how a host of economic uncertainties pan out. Chief among these is, of course, the trade war.

Machinery. Farmers are dealing with bumper crops and Asian markets not buying their products (like soybeans and sorghum). This likely will keep the agricultural equipment market soft. Ag equipment is part of The Watch’s machinery sector forecast, which, despite everything, is showing some modest growth (see Figures 5 and 6).

“That’s because of the BBB,” Kuehl said. “The Big Beautiful Bill [signed into law earlier this year] offers construction companies some nice nuggets of maximum depreciation, if they can start a project this year. And if they don’t finish it by 2030, they don’t get the money back. So, every construction company we’re dealing with is trying to get in on that. To finish on time, they need people and they need machines.”

These diverging factors are part of what’s driving the large “cone of variability” in the machinery space. If companies successfully navigate through trade uncertainties, demand could rise significantly. If not, and if the BBB incentives fail to have the desired results, demand could sink just as significantly.

Automotive. Supply chain factors continue to weigh into the automotive forecast. “We’ve reached 16 million vehicles this year,” Kuehl said, “and that hasn’t happened for a while. But tariffs are a concern, because there’s no industry in the world more global than automotive.” Then there’s the issue of consumer debt. “Car loans are starting to be as bad as they were during the last recession.” Kuehl added that nowhere is the K-shaped recovery more evident than in automotive. The upper third of income earners are spending, especially on luxury vehicles.

Transportation. “Aerospace is going through a bit of a renaissance right now,” Kuehl said (see Figure 7). “Not only is demand up for new airplanes, but they’re retrofitting the ones that are out there.”

Meanwhile, commercial trucking is poised for moderate growth, though nothing spectacular. “People in the industry are still talking about a trucking recession,” Kuehl said. “One of the most immediate impacts of the trade war was a real decline in inbound and outbound freight. You had a lot of trucking companies that really depended on that. They’re now struggling.

“We’ve also had a lot of consolidation in the less-than-load category,” Kuehl continued. This area of the trucking market—which serves loads too large for parcel carriers but too small to fill an entire truck—has fewer players than it once did. These larger companies are now competing with FedEx, UPS, and Amazon, which have everything from airplanes and Class 8 trucks all the way down to small delivery vans. “Their warehouse hub-and-spoke system is difficult to compete with,” Kuehl said. “Moreover, it didn’t do manufacturers any good when Yellow [the trucking company] collapsed. That put about 48,000 tractors on the market overnight.”

Meanwhile, some players in the rail industry “have been hurt because they depended a lot on North-South trade between Canada, Mexico, and the U.S. Despite the political talk, trade hasn’t dried up, mainly because we have the USMCA. That’s a treaty. We can nibble around the edges, but for the most part, we can’t mess with it.”

Still, the rail industry “also might see a bit of a renaissance in 2026,” Kuehl said, “partly because of all the activity around the BBB in getting these new construction projects off the ground. There’s going to be a lot of movement of steel, and a lot of movement of heavy machinery.”

A Repeat of the Telecom Boom?

History might not repeat itself exactly, but it does rhyme—and anyone who worked in metal fabrication through the telecom boom of the late 1990s can hear that rhyming. But from a metal fabricator’s perspective, booms have their benefits. The telecom boom accelerated the use of CO2 laser cutting. Today, the AI boom is accelerating investment: Think of this year’s FABTECH, which broke exhibit-space records. And as Joe Hogg, president and founder of Charlotte, N.C.-based Inflexion Financial, explained in a late-September interview shortly after the show, “I think we’re only in the fourth or fifth inning with respect to the data center trade.”

FIGURE 2. Numbers behind the computers and electronics product sector show an industry benefiting from the data center boom. Numbers going back to early 2024 remain far above the benchmark set in 2017.

Another aspect that separates AI from previous booms is just how pervasive it is—and the fact that it’s pushing energy investment to new heights. That’s good news for fabricators serving the power generation sector.

As a 2026 forecast on energy from Deloitte stated, “AI is no longer just increasing energy demand; it’s also reshaping it. Peak power demand could increase by 26% by 2035, propelled by the rapid growth of data centers and electrification.”

Positives and Negatives

As Kuehl described it, the current economic state is a balance of positives and negatives. On the one hand, you have positive signals coming not only from data centers, but also from defense spending (especially considering the geopolitics of the moment) as well as falling interest rates that could boost demand for big-ticket items. On the other hand, uncertainties abound around tariffs and a dysfunctional government.

Deloitte’s report on oil and gas aptly described the juggling of positives and negatives. Companies in the sector are benefiting from favorable government policy, yet “tariff-driven cost inflation could drive operators to fortify their supply chains through actions such as localization, modular builds, and contracting.” Supply chain localization benefits local metal fabricators, especially those that sell not only traditional products the sector needs—piping skids, vessel fabrication, and the like—but also enclosures and related products to help energy suppliers build their own AI infrastructure.

As Deloitte pointed out, “The [oil and gas] industry will likely accelerate the transition from pilot projects to full-scale deployment of AI and generative AI.” If those operational efficiencies truly become real, not just in oil and gas but across the economy, we might be in store for some transformational change. And as Kuehl explained, so many elements of this change—the infrastructure of what could be a new, AI-driven world—involve fabricated metal.

“We see the data center growth. We see growth in medical devices. You see new technology appearing in hospitals. People forget that every little device, every server rack, every new electronic device has an enclosure and similar components. Fabricated metal is everywhere.”

ABOUT DIVERSIFICATION—AGAIN

Henry Moss, president of METALfx, a Willits, Calif.-based custom sheet metal fabricator, knows all about the boom-and-bust cycles of the semiconductor industry. “We know companies heavy in that industry that choose to ride its ups and downs.”

He added that he understands the thinking behind focusing on high-growth areas. Some shops have thrived riding the waves. “But for us, we choose to stay diversified. It might cost us a little growth here and there, but it gives us better stability.”

Many leaders in this business have told me that success in custom metal fabrication reflects a well-diversified investment portfolio. A slice of the pie might have some high-growth stocks, and a few might not perform well at the moment, but they help mitigate the pain when those high-flying investments go south. The same goes with metal fabrication’s commitment to sectoral diversification.

METALfx’s experience through 2025 reflected this commitment. Moss described how managers kept their eye on the long game as tariff threats spurred multiple calls and emails.

FIGURE 3. The long-term story behind computers, electronics, and data centers is clear: growth ahead.

Our estimating group was flooded with all these new requests for quotes [RFQs],” he said. “We put filters in place, though. Ultimately, few of them turned into real opportunities. Most were just checking a box, finding a domestic price. We just had a ton of requests for benchmarking quotes.” For existing customers, benchmarking quotes have real value. “But when people are coming out of the woodwork just asking for quotes, it can be a complete waste of resources if that work never finds its way to your doorstep.”

Connie Bates, METALfx’s director of business development and marketing, recalled the business environment earlier this year. “People were definitely panicking, but our existing customers were not. They knew we weren’t going to disrupt their production by chasing after short-term opportunities.”

Research has been key here. On the surface, reshoring sounds great. But as Moss recalled, the vast majority of tariff-related RFQs METALfx saw earlier this year were for consumer goods, like items you might find on the shelves of Home Depot. With the tariff situation constantly changing, he knew such work probably wouldn’t turn into real opportunity.

So, what’s ahead for METALfx in 2026? “I’m going to use a term that I’ve heard more than any other these days: I’m cautiously optimistic. I think for us, 2026 is going to be a lot like 2025. It’ll be a single-digit-growth year. They’re also projecting a 1.3% increase in steel demand next year, which filters down to fabricators like us. It’s a good sign the big steel players are predicting an uptick next year.”

The California fabricator’s approach mirrors that of many in this business. That diversified revenue model is what makes custom and contract metal fabrication so attractive for stakeholders, from behind-the-scenes investors and top managers to front-line employees.

This isn’t a get-rich-quick business. That said, unlike some of the most hyped companies connected to AI, there’s no question about how fabricators make money. Moreover, a shop can cultivate a customer mix and define its sweet spot, the niche where it excels. Combine this with a renewed interest in American manufacturing overall, and the industry’s long-term forecast looks bright.

中文

中文 English

English